VALUATION OF

INVENTORIES – AS -2

INVENTORIES: It is defined as "A company’s merchandise, raw materials, finished & unfinished products

which have not yet been sold." These are considered liquid assets, since they

can be converted into cash quite easily. It includes finished goods, work-

in-progress, raw material, consumables, loose tools, etc., which are held for

resale or consumption.

Inventories should be valued at the lower of COST and NET REALIZABLE VALUE.

· COST: cost of purchase + cost of conversion + other

cost incurred to bring the inventory to its present location and condition.

· Cost of Purchase: It includes taxes, duties (except which

are later on recoverable by the enterprise from taxing authorities), freight

inward etc. Trade discount, rebate, duty drawback etc. will be deducted.

Cenvatable excise duty paid on inputs is excluded.

·

Cost of Conversion: It includes labour cost, fixed and

variable production overheads.

Ø Fixed production overhead: It should be allocated on the basis of normal

capacity. Actual production can be used if it approximates the normal capacity.

In

case of low production the unabsorbed fixed overhead will not be allocated to

inventory cost. But in case of abnormally high production the inventory cost

will be appropriately reduced so as to include actual fixed overhead over total

production.

· In case of joint products, joint cost should be allocated on some

reasonable and consistent bases. E.g. their respective sales valued at

separation stage or after further processing.

·

In case of by products, scraps etc.: If not very significant are

valued at net realizable value and this value is deducted from the cost of main

product.

·

Following should not be included in cost of inventory

Ø Storage cost

Ø Administrative overhead

Ø Selling and distribution cost

Ø Abnormal losses / wastages

Ø Interest and other borrowing cost

·

Specific pricing is applied for items that are not interchangeable and

goods and services which are produced and segregated for a specific purpose /

project.

·

Cost should be calculated by FIFO or weighted average method. Weighted

average can be calculated after every lot is received or on periodic basis.

i.e. periodic weighted average method.

·

Standard cost or retail method can be used for convenience if results

approximate the actual cost.

·

Comparison of cost and net realizable value should be done on item

basis or similar and interchangeable items can be grouped (i.e. group basis but

not on aggregate basis i.e. global basis) But it should not be based on a

classification like all finished goods, all raw materials, etc.

·

Net realizable value estimation will also consider the purpose for

which inventory is held. In case of firm contracts for sales, the contract

price and for the excess inventory general selling price will be considered.

Contingent loss on firm contract in excess of inventory held will be provided

as AS-4

·

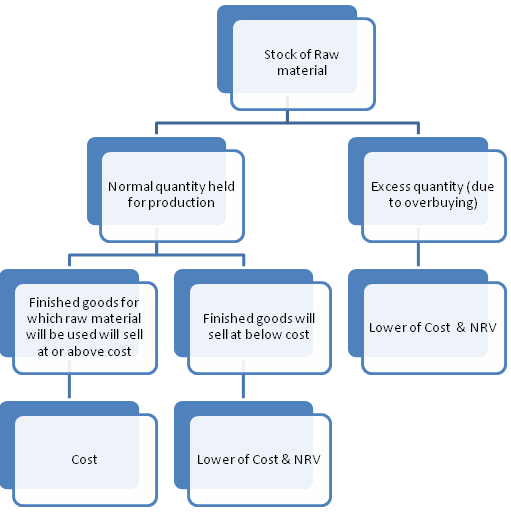

Material and other supplies held for use in the production of

inventories will generally be not valued below the cost if the net realizable value

of finished goods for which such material is going to be used will be equal to

or above the cost. Otherwise if material prices decline, the same will be

valued at lower than cost (which can be replacement cost.) Normal stock will

have to be written down to NRV if finished goods will sell at a loss. This is

because if the loss making finished goods is discontinued, stocks of raw

materials have to be sold off.

·

Disclosure in the financial statement in respect of AS -2 :

Ø Accounting policy adopted in measuring

inventories

Ø Cost formula used

Ø Classification of inventories: like

finished goods, WIP, raw material, spare parts and its carrying amount.

·

Summary :

Ø In case of high production, the overhead

should be allocated on the basis of actual production.

Ø Royalty based on production is part of

cost of inventory but royalty based on sale is not.

Ø Excise duty, paid or payable, in respect

of inventory of finished goods is a part of cost.

Ø Inventories be valued at cost net of ‘CENVAT’

credit.

Ø For buyer, the goods in transit are

included in inventory, only if the risk and rewards of ownership have passed to

him. If not, it is the inventory of the seller.

Ø Material given on loan is not an

inventory. Rather, it should be shown as Loans and Advances.

Ø Net realizable value should be estimated

at each balance sheet date.

Tree Diagram – Valuation of Stock of Raw

Material

|

| Valuation of Stock of Raw Material |

Books

referred: Students’ guide to Accounting Standards

No comments:

Post a Comment